Dublin, October 2, 2025

News Summary

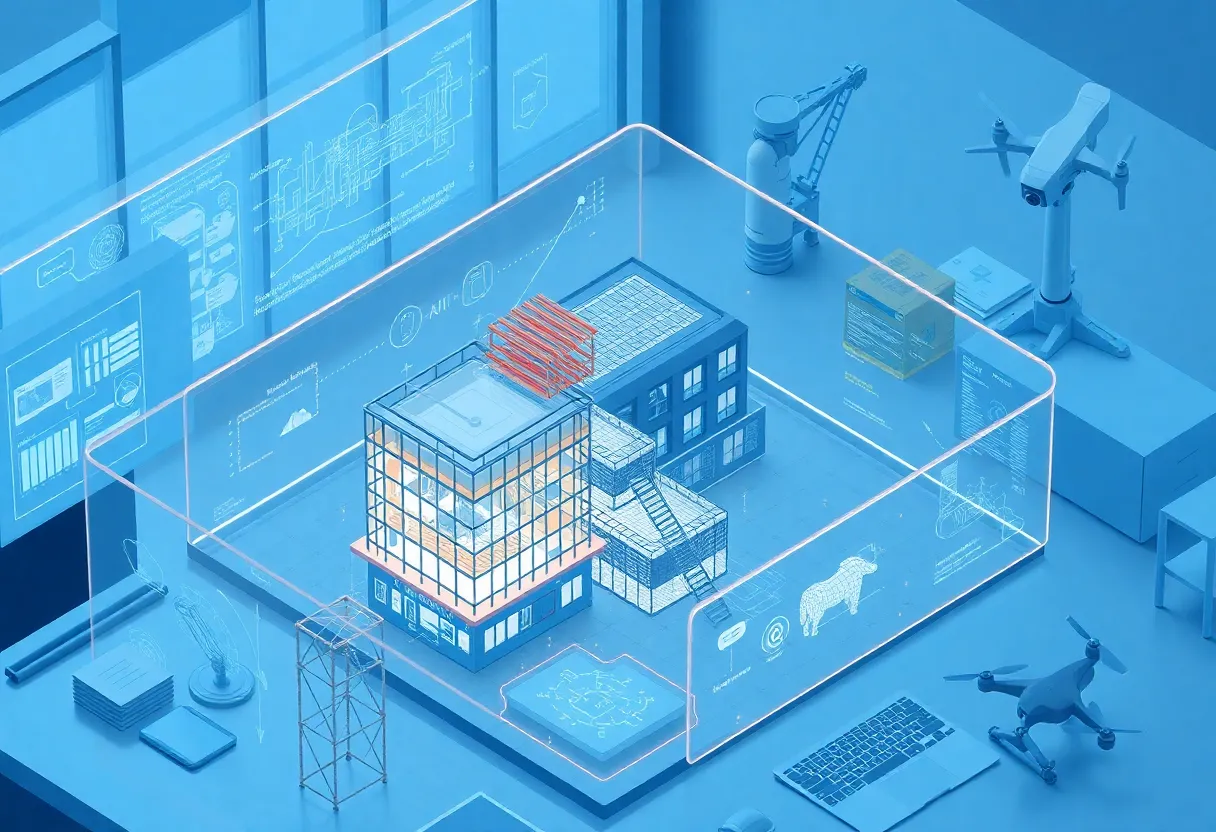

A new strategic report finds the global construction design software market expanding from an estimated US$9.9 billion to US$15.4 billion, driven by a projected 7.7% CAGR. The study highlights core capabilities such as 2D drafting, 3D modeling, BIM, structural analysis and real-time collaboration. Adoption is accelerating due to BIM mandates, cloud platforms, AI-enabled generative design, digital twins, AR/VR and SaaS models that lower entry barriers. Demand rises across mature and emerging markets while modular construction, smart city projects and sustainability requirements further boost uptake among firms, education institutions and public infrastructure programs.

Construction design software market set to grow from US$9.9B to US$15.4B by 2030

Date and time: October 02, 2025 04:36 ET. Location: Dublin. The report titled Construction Design Software – Global Strategic Business Report has been added to ResearchAndMarkets.com’s offering. The global market for Construction Design Software was estimated at US$9.9 billion in 2024. The market is projected to reach US$15.4 billion by 2030. The compound annual growth rate (CAGR) projected from 2024 to 2030 is 7.7%.

What the report covers

The study is described as comprehensive and provides an in-depth analysis of market trends, drivers, and forecasts to help make informed business decisions. Report features include Key Insights; Scope of Study; Key Attributes. Key Attributes / sections named: MARKET OVERVIEW; MARKET TRENDS & DRIVERS; FOCUS ON SELECT PLAYERS. The report features some of 34 companies.

Core functions and capabilities

Core software functions listed in the report include:

- Construction design software enables 2D drafting.

- It enables 3D modeling.

- It enables Building Information Modeling (BIM).

- It enables structural analysis.

- It enables real-time collaboration among stakeholders.

Role and benefits in AEC workflows

The report states that construction design software has become a cornerstone of modern architecture, engineering, and construction (AEC) workflows. These solutions transform how infrastructure and building projects are visualized, planned and executed. Digital design tools streamline workflows, enhance project accuracy and significantly reduce cost and time associated with manual design revisions and on-site changes. Software is used to simulate construction sequencing, simulate energy performance and for clash detection. Simulation and detection capabilities help mitigate risks before physical work begins. Such capabilities are critical in an industry where errors and inefficiencies can significantly impact budgets and timelines.

Market and regulatory drivers

Major drivers named in the report include a shift from conventional CAD to advanced BIM systems, redefining design approaches in large-scale residential, commercial and infrastructure projects. Governments in regions such as North America, Europe and Asia‑Pacific are mandating BIM usage for public infrastructure planning. BIM mandates reinforce the software’s role in achieving sustainability, cost transparency and lifecycle asset management. The increasing prevalence of regulatory mandates for digital documentation and compliance reporting is reinforcing software usage across public and private construction projects. Smart city initiatives, sustainable construction mandates and green building certifications are pushing adoption of design tools for energy modeling, materials analysis and lifecycle forecasting. The expansion of modular and prefabricated construction drives demand for precision design software that supports off-site planning and factory-based component fabrication. The rise of smart city initiatives and urban growth make digital design platforms move from optional tools to strategic necessities.

Technological trends reshaping design tools

Innovations reshaping the landscape include cloud computing, artificial intelligence (AI), and digital twin technologies. Cloud-based platforms allow for real-time data sharing and team collaboration and enable multiple stakeholders to work simultaneously on a single project model irrespective of location. Cloud collaboration is particularly valuable in hybrid work environments and projects with geographically distributed teams. AI integration supports generative design, which uses algorithms to suggest multiple design outcomes based on defined constraints. Generative design improves creativity and design efficiency. Digital twin technology creates a real‑time digital representation of a physical building or infrastructure asset and is being incorporated into BIM platforms for lifecycle management. Digital twins allow project managers to monitor structural health, optimize maintenance and simulate performance based on real‑time data. Augmented reality (AR) and virtual reality (VR) tools enhance stakeholder engagement by enabling immersive walkthroughs and spatial planning reviews. Software vendors are focusing on user experience (UX), offering intuitive interfaces and automation features to reduce learning curves and improve productivity for both large firms and smaller contractors. Strategic partnerships between software developers, construction tech firms and hardware providers (such as 3D scanners and drones) are creating ecosystems that streamline design‑to‑construction workflows. The emergence of Software-as-a-Service (SaaS) models and modular licensing options is lowering entry barriers for small and mid-sized firms, democratizing access to advanced digital design capabilities.

Demand by geography and market segment

Demand is growing in mature markets: United States, United Kingdom, Germany, Japan and Australia. Drivers in these developed economies include investments in smart city development, retrofitting and green building initiatives requiring advanced digital planning tools. Demand is also rising in emerging markets: India, Indonesia, Vietnam and several African nations. Drivers in emerging markets include investments in urbanization, transport infrastructure and affordable housing, creating need for scalable, cost-effective and collaborative design software. Education institutions and technical training centers are adopting construction design tools to train the next generation of engineers and architects, expanding the user base.

Business models and market access

SaaS and modular licensing lower entry barriers for small and mid-sized firms. Design tools integrated with construction management software, ERP systems and procurement platforms are becoming valuable for end-to-end project planning.

Related reports and additions

Other reports added on the same date include Offsite Construction – Global Strategic Business Report and Hydropower Plant Construction – Global Strategic Business Report.

Selected project examples illustrating digital design use

One local retail redevelopment approved by a city council involves demolition of two vacant commercial buildings and construction of a 33,125-square-foot multi-tenant building to provide relocation space for tenants and support a nearby downtown town square and new street grid network. The project site includes part of a parking lot and an existing building that is not slated for demolition. The city approval reversed an earlier planning commission decision after the developer revised plans to add landscaping, remove some parking spaces to enlarge pedestrian areas, shift the building north for seating and dog-relief space, enhance walkways and eliminate a one-way drive from a main boulevard. The council vote approved the site development review permit by a 4–1 margin.

Another infrastructure project is a long S‑shaped pedestrian and cyclist bridge that connects a downtown area with a riverside park. That bridge features a 760‑ft‑long S‑curve alignment, a 176 ft tall tower, a 500 ft main suspension span and unique triangular steel box girder geometry. The project used advanced geometric design tools and coordination among design, fabrication and construction teams, including overseas fabrication and on-site cable testing and installation.

A major hospital project combines services from three existing sites into a new 160,000 m2 children’s hospital with 6,000 rooms across seven above‑ground storeys. The facility has ambitious targets for lowering carbon emissions and was designed as a digital hospital with a clinical command centre and electronic health records systems. The project used thermal modelling to design an efficient building envelope, incorporated natural ventilation in non‑critical areas, specified high‑efficiency heating and cooling equipment, and included gardens and play areas to support patients. The design earned a recognized green building certification at design stage.

Why this matters

Growth in this software market reflects broader shifts in construction toward digital, collaborative and performance-driven workflows. For project teams, the reported expansion signals more widespread access to tools that can reduce risk, speed delivery and improve long‑term asset management.

FAQ

Q: What size is the global market for construction design software?

A: The global market for Construction Design Software was estimated at US$9.9 billion in 2024.

Q: What is the market projection to 2030?

A: The market is projected to reach US$15.4 billion by 2030.

Q: What is the projected growth rate?

A: The compound annual growth rate (CAGR) projected from 2024 to 2030 is 7.7%.

Q: What is the report title that was added?

A: The report titled Construction Design Software – Global Strategic Business Report has been added to ResearchAndMarkets.com’s offering.

Q: What core functions does construction design software provide?

A: Construction design software enables 2D drafting. It enables 3D modeling. It enables Building Information Modeling (BIM). It enables structural analysis. It enables real-time collaboration among stakeholders.

Q: When was the press release metadata dated?

A: Date and time: October 02, 2025 04:36 ET.

Key features at a glance

| Feature | Detail |

|---|---|

| Market size (2024) | US$9.9 billion |

| Projected market (2030) | US$15.4 billion |

| Projected CAGR (2024–2030) | 7.7% |

| Report | Construction Design Software – Global Strategic Business Report |

| Core capabilities | 2D drafting; 3D modeling; BIM; structural analysis; real-time collaboration |

| Key tech trends | Cloud, AI/generative design, digital twins, AR/VR, SaaS |

| Geographic demand | United States, United Kingdom, Germany, Japan, Australia, India, Indonesia, Vietnam, several African nations |

Deeper Dive: News & Info About This Topic

Additional Resources

- GlobeNewswire: Construction Design Software – Global Strategic Business Report

- Wikipedia: Building information modeling

- ENR: The Dublin Link (Best Project — highway/bridge)

- Google Search: The Dublin Link bridge

- SFYIMBY: Construction soon for 6700 Golden Gate Drive West Dublin

- Google Scholar: 6700 Golden Gate Drive Dublin

- Pleasanton Weekly: Dublin council clears commercial building

- Encyclopedia Britannica: Dublin California downtown development

- Arup: New Children’s Hospital project

- Google News: construction design software digital twins BIM

Author: Construction FL News

The FLORIDA STAFF WRITER represents the experienced team at constructionflnews.com, your go-to source for actionable local news and information in Florida and beyond. Specializing in "news you can use," we cover essential topics like product reviews for personal and business needs, local business directories, politics, real estate trends, neighborhood insights, and state news affecting the area—with deep expertise drawn from years of dedicated reporting and strong community input, including local press releases and business updates. We deliver top reporting on high-value events such as the Florida Build Expo, major infrastructure projects, and advancements in construction technology showcases. Our coverage extends to key organizations like the Associated Builders and Contractors of Florida and the Florida Home Builders Association, plus leading businesses in construction and legal services that power the local economy such as CMiC Global and Shutts & Bowen LLP. As part of the broader network, including constructioncanews.com, constructionnynews.com, and constructiontxnews.com, we provide comprehensive, credible insights into the dynamic construction landscape across multiple states.