New York City, September 18, 2025

News Summary

Venture funding concentrated on construction technology firms specializing in reality capture, projection and unified visual data platforms totaled $110 million, led by six startups. Major rounds included GreenLite’s $49.5M Series B for AI permitting review, Mechasys’s $23M Series A for XR projectors, DroneDeploy’s $15M strategic raise for AI products, LightYX’s $11M Series A for laser projection, Heave’s $7M Series A for equipment repair marketplace, and Track3D’s $4.3M seed for a reality intelligence hub. Separately, FieldAI closed a $405M financing. The report also covers New York workplace heat legislation developments and an East Village construction finishing update.

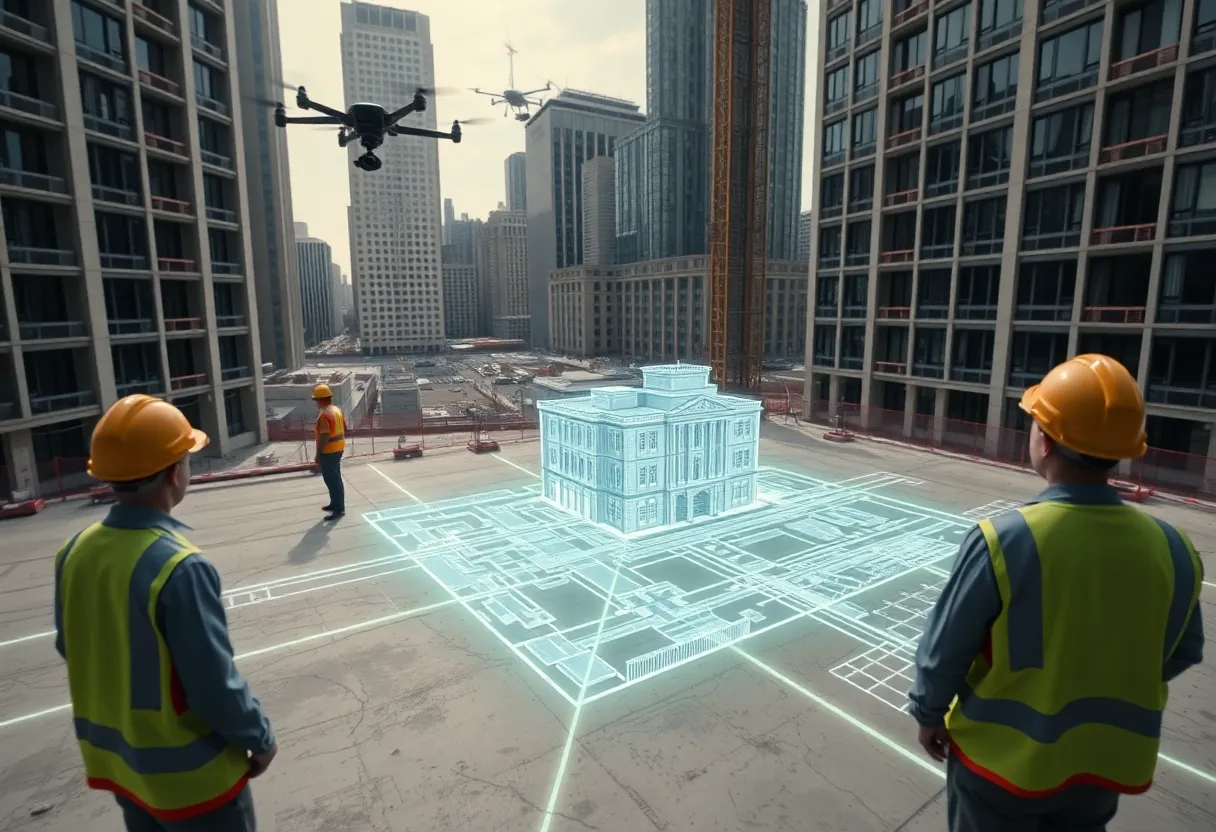

Reality-capture and projection startups led a recent wave of venture funding, with six firms taking the lion’s share of a $110 million funding round

Investment in construction technology focused on reality capture, projection, and unified visual data platforms dominated the latest venture activity. Startups that convert jobsite scans and drone imagery into a single source of truth or that project plans directly onto surfaces were the principal recipients in a round that totals $110 million. This total does not include a separate financing in August when FieldAI pulled in $405 million.

Top rounds and what the companies do

GreenLite raised $49.5 million in a Series B funding round. The Series B was led by Insight Partners. Energize Capital participated in the round. Existing investors Craft Ventures, LiveOak Ventures and Chicago Ventures also participated. GreenLite provides AI-powered permitting review software. GreenLite’s AI-powered digital plan review tool is called LiteTable. LiteTable can ingest plan sets, identify compliance flags and code requirements, and find relevant guidance from GreenLite’s comment library based on compliance patterns within specific jurisdictions. With the capital, GreenLite plans to expand go-to-market efforts and enter new verticals: lodging, industrial and logistics, clean energy infrastructure, and residential development. GreenLite also plans to advance its technology platform.

Mechasys raised $23 million in a Series A funding round. The Series A was announced on Aug. 26. The round was led by Idealist Capital. Fondaction provided follow-on participation as an existing investor. Mechasys specializes in projected reality technology. The technology is known as the XR projector. The XR projector creates true 1:1 scale layouts with millimetric accuracy. The XR projector aims to eliminate guesswork and significantly reduce rework. Mechasys’s tech is used on more than 200 construction projects across over a dozen countries. With the funding, Mechasys will accelerate deployment of its third-generation XR Projector.

DroneDeploy raised $15 million in strategic funding. The company announced reaching break-even at the time of the Sept. 9 news release. Existing investors include co-lead investors Emergence Capital and Scale Venture Partners. Other existing investors include Airtree Ventures, Bessemer Venture Partners and Uncork Capital. The fundraise targeted development behind two new AI products: Progress AI and Safety AI. Progress AI is a vision-language solution to deliver automated progress tracking from drone and 360 walkthrough data. Safety AI is tracking jobsites to ensure OSHA and safety compliance. The capital will be used for DroneDeploy’s robotics capabilities and to advance autonomous capture for quadruped, aerial and future humanoid systems.

LightYX raised $11 million in a Series A funding round. The funding round was announced in a Sept. 2 news release. The round was led by Nova by Saint-Gobain. Other participants included Yachad Capital Partners, Shibumi International, Somersault Ventures and private investors in real estate and construction from Israel. LightYX specializes in precise, on-site laser projection of building plans. The company has developed an electro-optical system that uses laser projection to display construction plans directly onto floors, ceilings, and walls. LightYX’s system projects with 1/16-inch accuracy (under 2 millimeters). The system also scans and adapts plans in real time to reflect field conditions. LightYX is headquartered in Tel Aviv with operations in New York City. LightYX has received six grants from the Israel Innovation Authority totaling $3.3 million since its inception. With the funding, LightYX plans to target U.S. expansion, accelerate product development, build new partnerships in the U.S. and Europe, and deepen customer relationships.

Heave raised $7 million in a Series A funding round. The news release announcing this was dated Aug. 27. Outsiders Fund led the round. Continued support came from FJ Labs, Long Journey Ventures and Slow Ventures. The Aug. 27 round brings Heave’s total funding to $13 million. Heave describes its service as Uber for heavy equipment repair. Heave’s platform connects mobile mechanics with professionals whose machines need a fix. The company services more than 600 machines per month. Heave has over 300 active mechanics in its network out of a total pool of 850 nationwide. Heave has a regional presence in Florida and Texas. Heave is expanding into the Charlotte, North Carolina; Nashville, Tennessee; and Atlanta regions. With the new capital, Heave plans to fuel market expansion, customer acquisition and team growth.

Track3D raised $4.3 million in a Seed funding round. The company announced the fundraise in a Sept. 10 news release. The Seed round was led by Endiya Partners. Participants included Shadow Ventures, Monta Vista Capital and others. Track3D is building a reality intelligence platform for the construction industry. The Track3D platform acts as a central hub for visual data from drones, 360 cameras, laser scanners, and mobile devices. With that data, contractors can automatically track documentation and progress on the jobsite and streamline communication with project stakeholders. With the funding, Track3D plans to expand product offerings and bolster go-to-market efforts.

Separately, FieldAI pulled in $405 million in August and is described as Bill Gates- and Nvidia-backed and as a robot brain software maker. That financing sits outside the $110 million total noted above.

State-level worker safety and the T.E.M.P. proposal in New York

A previously passed Temperature Extreme Mitigation Program (the T.E.M.P. Act) was not signed into law as passed in 2023 and was not passed again by the New York Assembly and New York Senate during the 2024 legislative session, which ended in June 2024. The passed-but-not-enacted bill would have regulated extreme temperatures and granted protection to workers during both winter and summer months. Provisions described in the previously passed bill include specific employer requirements and workplace protections:

- Employers required to provide one quart of water per hour per employee.

- Outdoor employees required to have ten minutes in the shade for each two hours of work.

- Indoor employees required to have ten minutes in a “cooler breakroom.”

- The “cooler breakroom” would be required to maintain a temperature between 75 and 80.5 degrees when outdoor temperature exceeds 85 degrees.

- Employers required to maintain a “Workplace Heat Stress Plan.”

- Employers required to ensure that shade is available when the temperature does not exceed 80 degrees.

- The Bill provided similar protections during periods of cold weather, including access to areas with adequate warmth.

- Employers would be required to provide Personal Protective Equipment for cold weather, including gloves, hats and winter coats.

- The Bill also required that vehicles be equipped with heating and air conditioning if employees are to be in the vehicle for periods in excess of one hour.

The broader legal landscape remains shaped by New York Labor Law §240(1), known as the Scaffold Law, which offers strict liability protections to construction workers required to work at elevated height and protections from objects which fall from an elevated height. The statute places the onus of worker protection on contractors and owners of commercial property, and a worker’s own negligence is not a defense to a Labor Law §240(1) case. The statute specifically exempts owners of one- and two-family dwellings who do not direct or control the work.

Manhattan East Village construction update: 3 St. Mark’s Place

Construction is wrapping up on an eight-story commercial building at 3 St. Mark’s Place in Manhattan’s East Village. The building was designed by Morris Adjmi Architects and developed by Real Estate Equities Corporation. The property, alternately addressed as 23-25 Third Avenue, will yield 53,000 square feet of office space, include 7,800 square feet of ground-floor retail space, and have a cellar level. The building includes three wraparound terraces on the fifth, eighth, and roof levels.

Sidewalk scaffolding has been disassembled since the prior update. The protective blue film that covered the inside of large window panels has been removed, revealing the finished appearance. Some plastic sidewalk barriers and metal fencing remain in place by the front doors with an expectation they should be removed within the coming weeks. The developer purchased the site for $29 million in 2018. The original intention was to construct a much taller 53,000-square-foot office tower; the project scope was later downsized when a $70 million refinance revived the project. Sephora is planning to occupy the ground level of the new building. The closest subway access is the local 6 train at the Astor Place station to the west; one block further west are the R and W trains at the corner of East 8th Street and Broadway. The building is expected to fully finish sometime before the end of the year.

FAQ

What funding did GreenLite raise?

GreenLite raised $49.5 million in a Series B funding round. The Series B was led by Insight Partners. Energize Capital participated in the round. Existing investors Craft Ventures, LiveOak Ventures and Chicago Ventures also participated.

What is GreenLite’s product and plans?

GreenLite provides AI-powered permitting review software. GreenLite’s AI-powered digital plan review tool is called LiteTable. LiteTable can ingest plan sets, identify compliance flags and code requirements, and find relevant guidance from GreenLite’s comment library based on compliance patterns within specific jurisdictions. With the capital, GreenLite plans to expand go-to-market efforts and enter new verticals: lodging, industrial and logistics, clean energy infrastructure, and residential development. GreenLite also plans to advance its technology platform.

What funding did Mechasys raise?

Mechasys raised $23 million in a Series A funding round. The Series A was announced on Aug. 26. The round was led by Idealist Capital. Fondaction provided follow-on participation as an existing investor.

What is Mechasys’s technology?

Mechasys specializes in projected reality technology. The technology is known as the XR projector. The XR projector creates true 1:1 scale layouts with millimetric accuracy. The XR projector aims to eliminate guesswork and significantly reduce rework. Mechasys’s tech is used on more than 200 construction projects across over a dozen countries. With the funding, Mechasys will accelerate deployment of its third-generation XR Projector.

What funding did DroneDeploy raise and what will it build?

DroneDeploy raised $15 million in strategic funding. The company announced reaching break-even at the time of the Sept. 9 news release. Existing investors include co-lead investors Emergence Capital and Scale Venture Partners. Other existing investors include Airtree Ventures, Bessemer Venture Partners and Uncork Capital. The fundraise targeted development behind two new AI products: Progress AI and Safety AI. Progress AI is a vision-language solution to deliver automated progress tracking from drone and 360 walkthrough data. Safety AI is tracking jobsites to ensure OSHA and safety compliance. The capital will be used for DroneDeploy’s robotics capabilities and to advance autonomous capture for quadruped, aerial and future humanoid systems.

What funding did LightYX raise and what is its accuracy?

LightYX raised $11 million in a Series A funding round. The funding round was announced in a Sept. 2 news release. The round was led by Nova by Saint-Gobain. Other participants included Yachad Capital Partners, Shibumi International, Somersault Ventures and private investors in real estate and construction from Israel. LightYX’s system projects with 1/16-inch accuracy (under 2 millimeters). LightYX has received six grants from the Israel Innovation Authority totaling $3.3 million since its inception.

What funding did Heave raise and what is its service?

Heave raised $7 million in a Series A funding round. The news release announcing this was dated Aug. 27. Outsiders Fund led the round. Continued support came from FJ Labs, Long Journey Ventures and Slow Ventures. The Aug. 27 round brings Heave’s total funding to $13 million. Heave describes its service as Uber for heavy equipment repair. Heave’s platform connects mobile mechanics with professionals whose machines need a fix. The company services more than 600 machines per month. Heave has over 300 active mechanics in its network out of a total pool of 850 nationwide.

What funding did Track3D raise?

Track3D raised $4.3 million in a Seed funding round. The company announced the fundraise in a Sept. 10 news release. The Seed round was led by Endiya Partners. Participants included Shadow Ventures, Monta Vista Capital and others. Track3D is building a reality intelligence platform for the construction industry.

What happened with the T.E.M.P. Act?

The Temperature Extreme Mitigation Program (the T.E.M.P. Act) was not signed into law as passed in 2023 and was not passed again by the New York Assembly and New York Senate during the 2024 legislative session, which ended in June 2024.

What are the workplace provisions described in the previously passed bill?

Provisions described in the previously passed bill include: Employers required to provide one quart of water per hour per employee; Outdoor employees required to have ten minutes in the shade for each two hours of work; Indoor employees required to have ten minutes in a “cooler breakroom”; The “cooler breakroom” would be required to maintain a temperature between 75 and 80.5 degrees when outdoor temperature exceeds 85 degrees; Employers required to maintain a “Workplace Heat Stress Plan”; Employers required to ensure that shade is available when the temperature does not exceed 80 degrees; The Bill provided similar protections during periods of cold weather, including access to areas with adequate warmth; Employers would be required to provide Personal Protective Equipment for cold weather, including gloves, hats and winter coats; The Bill also required that vehicles be equipped with heating and air conditioning if employees are to be in the vehicle for periods in excess of one hour.

What is the status of the East Village building at 3 St. Mark’s Place?

Construction is wrapping up on 3 St. Mark’s Place, an eight-story commercial building in Manhattan’s East Village. The building will yield 53,000 square feet of office space and include 7,800 square feet of ground-floor retail space. The sidewalk scaffolding has been disassembled since the last update. The protective blue film that covered the inside of all the large window panels has since been removed, revealing the finished appearance of the building. Some plastic sidewalk barriers and metal fencing remain in place by the front doors, with an expectation they should be removed within the coming weeks. Sephora is planning to occupy the ground level of the new building. YIMBY expects the building to fully finish sometime before the end of the year.

Key features and quick reference table

| Company | Location | Round & amount | Lead investor | Primary product / use of proceeds |

|---|---|---|---|---|

| GreenLite | New York City | Series B, $49.5 million | Insight Partners | AI-powered permitting review; expand verticals and advance platform (LiteTable) |

| Mechasys | Montreal | Series A, $23 million | Idealist Capital | Projected reality XR projector; deploy third-generation device |

| DroneDeploy | San Francisco | Strategic funding, $15 million | Existing investors (Emergence Capital, Scale Venture Partners) | Develop Progress AI and Safety AI; robotics and autonomous capture |

| LightYX | Tel Aviv (operations in New York City) | Series A, $11 million | Nova by Saint-Gobain | On-site laser projection with 1/16-inch accuracy; U.S. expansion and product development |

| Heave | St. Petersburg, Florida | Series A, $7 million (total funding $13 million) | Outsiders Fund | Mobile heavy-equipment repair marketplace; market expansion |

| Track3D | Milpitas, California | Seed, $4.3 million | Endiya Partners | Reality intelligence platform aggregating drone/360/laser data; product expansion |

| FieldAI | — | August financing, $405 million | — | Robot brain software maker (Bill Gates- and Nvidia-backed) |

Deeper Dive: News & Info About This Topic

Additional Resources

- Legal Reader: Update on New York’s T.E.M.P. statute and insurance industry

- Wikipedia: Heat stress

- New York YIMBY: 3 St. Mark’s Place wraps up construction (East Village)

- Google Search: 3 St. Mark’s Place East Village

- The New York Times: U.S.-Britain nuclear deal (Sept 15, 2025)

- Google Scholar: US-Britain nuclear deal 2025

- Crain’s New York Business: NYC construction jobs below pre-pandemic levels

- Encyclopedia Britannica: construction industry New York City

- ConstructConnect: NY legislation covers suicide risk prevention training for construction

- Google News: New York suicide risk prevention training construction 2025

Author: Construction FL News

The FLORIDA STAFF WRITER represents the experienced team at constructionflnews.com, your go-to source for actionable local news and information in Florida and beyond. Specializing in "news you can use," we cover essential topics like product reviews for personal and business needs, local business directories, politics, real estate trends, neighborhood insights, and state news affecting the area—with deep expertise drawn from years of dedicated reporting and strong community input, including local press releases and business updates. We deliver top reporting on high-value events such as the Florida Build Expo, major infrastructure projects, and advancements in construction technology showcases. Our coverage extends to key organizations like the Associated Builders and Contractors of Florida and the Florida Home Builders Association, plus leading businesses in construction and legal services that power the local economy such as CMiC Global and Shutts & Bowen LLP. As part of the broader network, including constructioncanews.com, constructionnynews.com, and constructiontxnews.com, we provide comprehensive, credible insights into the dynamic construction landscape across multiple states.